Seabata Mahao

Food and non-alcoholic beverages have been identified as major contributors to the rise in domestic headline inflation, which increased to 6.5 percent in June 2024 from 6.3 percent in May 2024.

The weaker exchange rate continues to be a challenge, exacerbating the elevated domestic headline inflation. This was disclosed by Central Bank of Lesotho (CBL), Governor Dr. Maluke Letete following the latest apex bank’s Monetary Policy Committee (MPC) meeting.

Among its resolutions, the MPC maintained the Net International Reserves (NIR) target floor at USD 760 million (approximately M13.91 billion). At this level, the NIR target will be sufficient to maintain a one-to-one exchange rate peg between the Loti and the Rand.

The CBL rate will also be maintained at 7.75 percent per annum, considering NIR developments, regional inflation, interest rates outlook, domestic economic conditions, and the global economic outlook.

Speaking at the MPC briefing, the Governor of CBL, Dr. Maluke Letete, noted that the July 2024 International Monetary Fund (IMF) growth projections for the global economy were relatively unchanged from the April 2024 projections.

“Government operations registered a deficit of 1.7 percent of GDP in May 2024. The deficit was due to relatively higher government spending. During the same period, the stock of public debt as a percentage of GDP declined to 52.4 percent from a revised 53.0 percent in the preceding month,” Dr. Letete said.

Dr Letete further mentioned that the global economy is forecast to grow by 3.2 percent in 2024, with a slight upward revision to 3.3 percent in 2025. This growth is expected to be largely driven by strong performance in emerging markets and developing economies, particularly India and China. However, risks to global growth include elevated inflation, renewed trade tensions, and escalating geopolitical conflicts.

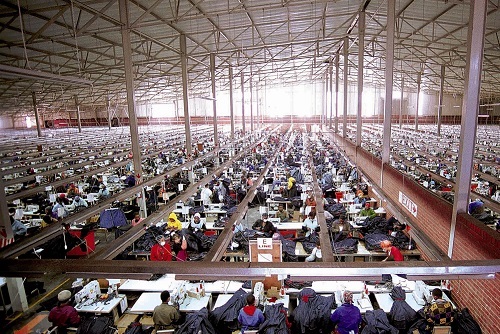

“The domestic economic activity grew for the second consecutive month in May 2024, registering 1.0 percent growth following a 0.9 percent increase in April 2024. This growth was primarily driven by stronger performance in the construction and financial services sectors. However, domestic demand and manufacturing sector activity moderated the expansion. In the near term, growth is expected to be stronger, mainly due to Lesotho Highlands Water Project (LHWP) construction activity and its spillover effects on service industries.”

Dr Letete highlighted that the money supply (M2) remained unchanged in May 2024 compared to the preceding month, reflecting a decline in transferable deposits held by other financial corporations, which was offset by an increase in household savings and deposits. Despite this, private sector credit grew, supported by ongoing construction activities around the country.

He also noted that the CBL’s NIR increased by approximately USD 119.29 million between May 2024 and July 18, 2024, mainly due to SACU receipts and increased water royalties during the same period. The NIR is expected to improve in the next three quarters to March 2025, with cyclical peaks and troughs.

“Economic activity was generally divergent across most selected advanced and emerging market economies in the first quarter of 2024. In advanced economies, economic activity improved, mainly underpinned by strong domestic demand, except in Japan and the United States. Growth in emerging markets and developing economies remained robust due to stronger industrial production, except in South Africa, which faced weak demand both externally and domestically,” Dr. Letete said.

Dr. Letete concluded that global growth is expected to remain resilient in 2024 despite the risks to the outlook. The domestic economy grew modestly but is expected to expand in the medium term.

“The Committee will continue to closely monitor global economic developments and their impact on the domestic economy, especially the NIR, and respond accordingly,” he added.

Summary

- At this level, the NIR target will be sufficient to maintain a one-to-one exchange rate peg between the Loti and the Rand.

- In the near term, growth is expected to be stronger, mainly due to Lesotho Highlands Water Project (LHWP) construction activity and its spillover effects on service industries.

- Dr Letete highlighted that the money supply (M2) remained unchanged in May 2024 compared to the preceding month, reflecting a decline in transferable deposits held by other financial corporations, which was offset by an increase in household savings and deposits.

Your Trusted Source for News and Insights in Lesotho!

At Newsday Media, we are passionate about delivering accurate, timely, and engaging news and multimedia content to our diverse audience. Founded with the vision of revolutionizing the media landscape in Lesotho, we have grown into a leading hybrid media company that blends traditional journalism with innovative digital platforms.