Bereng Mpaki

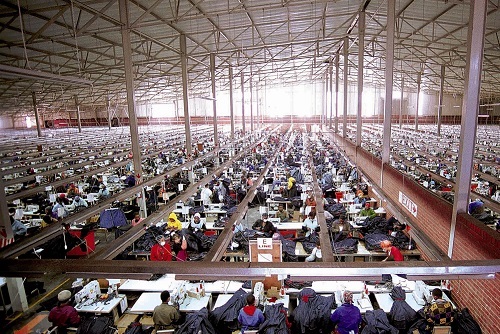

The ongoing underperformance of the manufacturing sector is threatening to undermine the positive economic activity being generated elsewhere.

The Central Bank of Lesotho (CBL) recently said Lesotho’s domestic economic activity recorded improvement driven by growth in the construction, transport and financial sectors in July this year.

The growth was, however, offset by the persistent weakening of the manufacturing sector and its subdued demand, as the global economic growth remains weakened.

The United States (U.S.), which is the primary market for Lesotho’s manufacturing sector products, recorded a rise in the unemployment rate due to job losses in its transport sector.

Due to the weakening global economy, firms in Lesotho have been downsizing their operations and laying off thousands of workers in the aftermath of the Covid-19 pandemic.

Data from the Bureau of Statistics (BOS) shows that the number of employees in the manufacturing sector climbed from 39 264 in the third quarter of 2022 to 37 232 in the first quarter of 2023.

“The continued poor performance of the manufacturing sector, driven by slowing global trade and demand, could negatively affect the economy,†CBL governor Dr Maluke Letete said.

“Looking ahead, the Lesotho Highlands Water Project (LHWP) Phase II and its associated spill-over effects are projected to serve as drivers of growth in the medium term.â€

Dr Letete was addressing the media following the apex bank’s latest Monetary Policy Committee (MPC) meeting, in which the committee deliberated on global, regional, and domestic economic developments, as well as the latest trends in financial markets, to inform its policy decisions.

The committee maintained the CBL rate at 7.75 percent while reducing the net international reserves (NIR) target floor to US$710 million.

“Having considered the net international reserves (NIR) developments and outlook, regional inflation and interest rates outlook, domestic economic conditions and the global economic outlook, the MPC decided to revise the NIR target floor from US$820 million to US$710 million,†Dr Letete said.

“At this level, the NIR target will be sufficient to maintain a one-to-one exchange rate peg between Loti and the Rand. The MPC has also decided to leave the CBL rate unchanged at 7.75 percent per annum.â€

Despite the soaring food prices in the market, the inflation rate fell to 4.5 percent in July 2023 from 5.6 percent in June 2023, according to Dr Letete.

“This was a result of declining food, fuel, and clothing prices. However, increased alcohol and tobacco levies and the weak exchange rate moderated the fall in the inflation rate. Despite the recent moderation in inflation, the continued weaker loti and the risk of El Niño present upside risks to the medium-term inflation outlook.â€

The broad supply of money circulating within the economy declined moderately in July 2023 compared to the preceding month, he said.

“This was due to a fall in net domestic assets, as government deposits with CBL increased. Meanwhile, private sector credit increased, mostly reflecting credit extended to households while business credit remained subdued.â€

Summary

- Data from the Bureau of Statistics (BOS) shows that the number of employees in the manufacturing sector climbed from 39 264 in the third quarter of 2022 to 37 232 in the first quarter of 2023.

- Dr Letete was addressing the media following the apex bank’s latest Monetary Policy Committee (MPC) meeting, in which the committee deliberated on global, regional, and domestic economic developments, as well as the latest trends in financial markets, to inform its policy decisions.

- “Having considered the net international reserves (NIR) developments and outlook, regional inflation and interest rates outlook, domestic economic conditions and the global economic outlook, the MPC decided to revise the NIR target floor from US$820 million to US$710 million,†Dr Letete said.

Your Trusted Source for News and Insights in Lesotho!

At Newsday Media, we are passionate about delivering accurate, timely, and engaging news and multimedia content to our diverse audience. Founded with the vision of revolutionizing the media landscape in Lesotho, we have grown into a leading hybrid media company that blends traditional journalism with innovative digital platforms.