Bereng Mpaki

The poor performance of the global diamond market has negatively impacted on Letšeng Diamonds’ majority shareholder, Gem Diamonds’ profit which declined by a massive 92 percent during 2023.

The company recorded a profit of US$1.6 million (about M28.8 million) for the financial year ended December 2023, reflecting a sharp decline from US$20.2 million (about M363.6 million) recorded for the year ended December 2022.

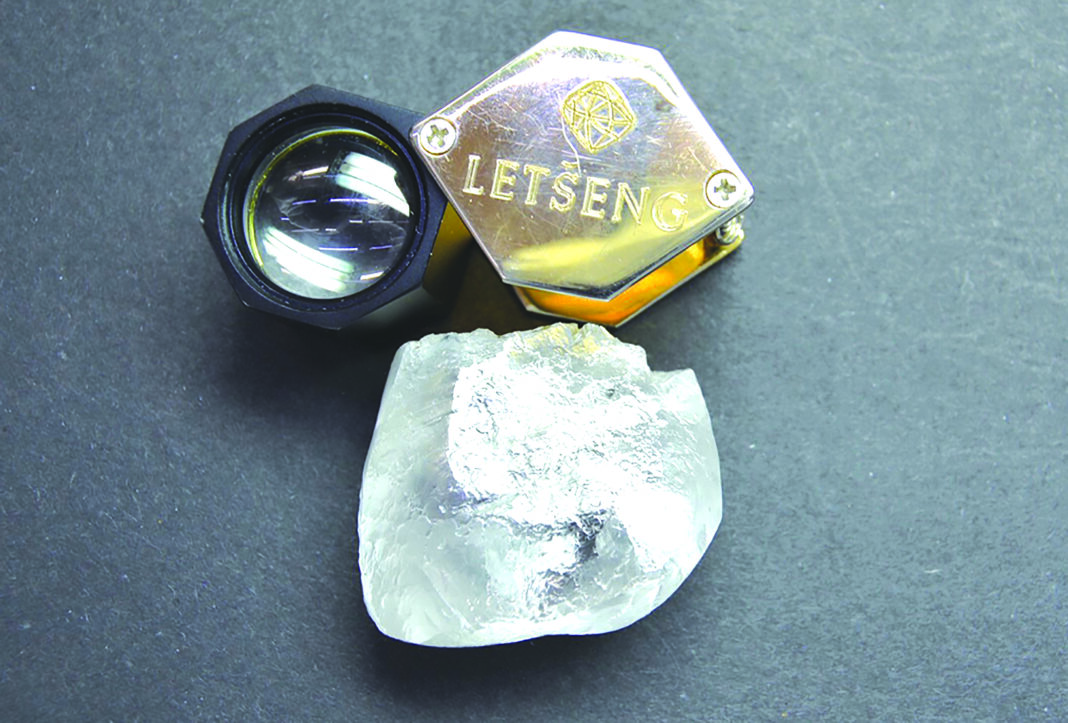

Gem Diamonds owns 70 percent of Letšeng Diamonds, which is famous for producing large, exceptional white diamonds, and is regarded as the highest-dollar-per-carat kimberlite diamond mine in the world.

The company also recorded a 65 percent decline in earnings before interest, taxes, depreciation, and amortisation (EBIDTA), climbing down from US$43 million in 2022 to US$15 million in 2023.

“The turbulent global economic conditions from the previous year continued into 2023 with high inflation, interest rate hikes and slow overall economic growth in major economies which impacted the diamond market,” reads a report on Gem Diamonds’ 2023 results.

The report, which was published yesterday further indicated that the pressure experienced on the diamond market significantly impacted rough and polished diamond prices, which resulted in a 26 percent decrease in revenue.

“Despite the implementation of numerous cost containment measures, EBITDA decreased by 65 percent,” added the report.

Gem’s Chief Executive Officer, Clifford Elphick said their financial performance suffered due to poor rough diamond prices in the market.

“2023 was a challenging year globally with surging inflation and interest rate increases in major economies, two international conflicts and a subdued overall global economic outlook which had a significant negative impact on the diamond industry.

“Our financial results suffered primarily as a result of a decrease in revenue because of lower diamond prices. We have relentlessly focused on cost control measures, enhanced operational efficiencies, rigorous evaluation of capital projects and the deferment of non-essential longer-term projects.

He said the pressure on the diamond market has persisted into 2024, although there were some signs of price recovery.

“We are cautiously optimistic that prices will stabilise and that there will be some growth towards the end of 2024.”

Despite the gloomy financial year, Gem was still able to record the highest dollar-per-carat price for a white rough diamond valued at US$36 399 (about M655 182.00) per carat during the year.

The total amount of recovered carats also increased to 109 656 during 2023, up from 106 704 carats recovered in 2022.

Summary

- “The turbulent global economic conditions from the previous year continued into 2023 with high inflation, interest rate hikes and slow overall economic growth in major economies which impacted the diamond market,” reads a report on Gem Diamonds’ 2023 results.

- The report, which was published yesterday further indicated that the pressure experienced on the diamond market significantly impacted rough and polished diamond prices, which resulted in a 26 percent decrease in revenue.

- “2023 was a challenging year globally with surging inflation and interest rate increases in major economies, two international conflicts and a subdued overall global economic outlook which had a significant negative impact on the diamond industry.

Your Trusted Source for News and Insights in Lesotho!

At Newsday Media, we are passionate about delivering accurate, timely, and engaging news and multimedia content to our diverse audience. Founded with the vision of revolutionizing the media landscape in Lesotho, we have grown into a leading hybrid media company that blends traditional journalism with innovative digital platforms.