Staff Reporter

Gem Diamonds, the mining group with operations in Lesotho and Botswana, has reported a significant drop in revenue and underlying earnings before interest, taxes, depreciation, and amortization (EBITDA) for the first half of 2023.

The company, headquartered in the United Kingdom, owns the renowned Letšeng diamond mine in Mokhotlong and the Ghaghoo mine in Botswana, with sales and marketing capabilities based in Belgium and innovation solutions in Cyprus.

During the first six months of this year, Gem Diamonds generated a revenue of US$71.8 million, a notable decrease from the US$100.0 million revenue generated during the same period last year.

The underlying EBITDA also saw a substantial decline, dropping to US$8.4 million from the US$20.9 million reported a year ago.

The company attributed these declining financial figures to weak demand and prices for goods from its high-value Letšeng mine in Lesotho.

Sales volume from the Letšeng mine declined by nine per cent, resulting in the sale of 52,163 carats during this period. Additionally, the average price per carat experienced a 21 per cent decrease, falling to $1,373 per carat.

Gem Diamonds provided insight into the factors contributing to these financial challenges, stating: “A decrease in the number of large, high-value diamonds recovered, combined with market pressure, has negatively impacted the average dollar per carat and revenue achieved during the period.â€

Furthermore, the mining company noted that it recovered two diamonds weighing over 100 carats during this period, down from three in the same period the previous year. Overall, 318 rough stones weighing more than 10 carats were unearthed from the deposit, compared to 374 in the first half of 2022.

Production for the first half of 2023 also decreased by eight percent, amounting to 50,601 carats.

This decline was primarily attributed to a drop in the volume of ore processed and was exacerbated by increased power outages caused by load shedding from South African electricity provider Eskom.

Letšeng mine experienced 180 days of load shedding during this period, compared to a total of 205 days for the entire year of 2022.

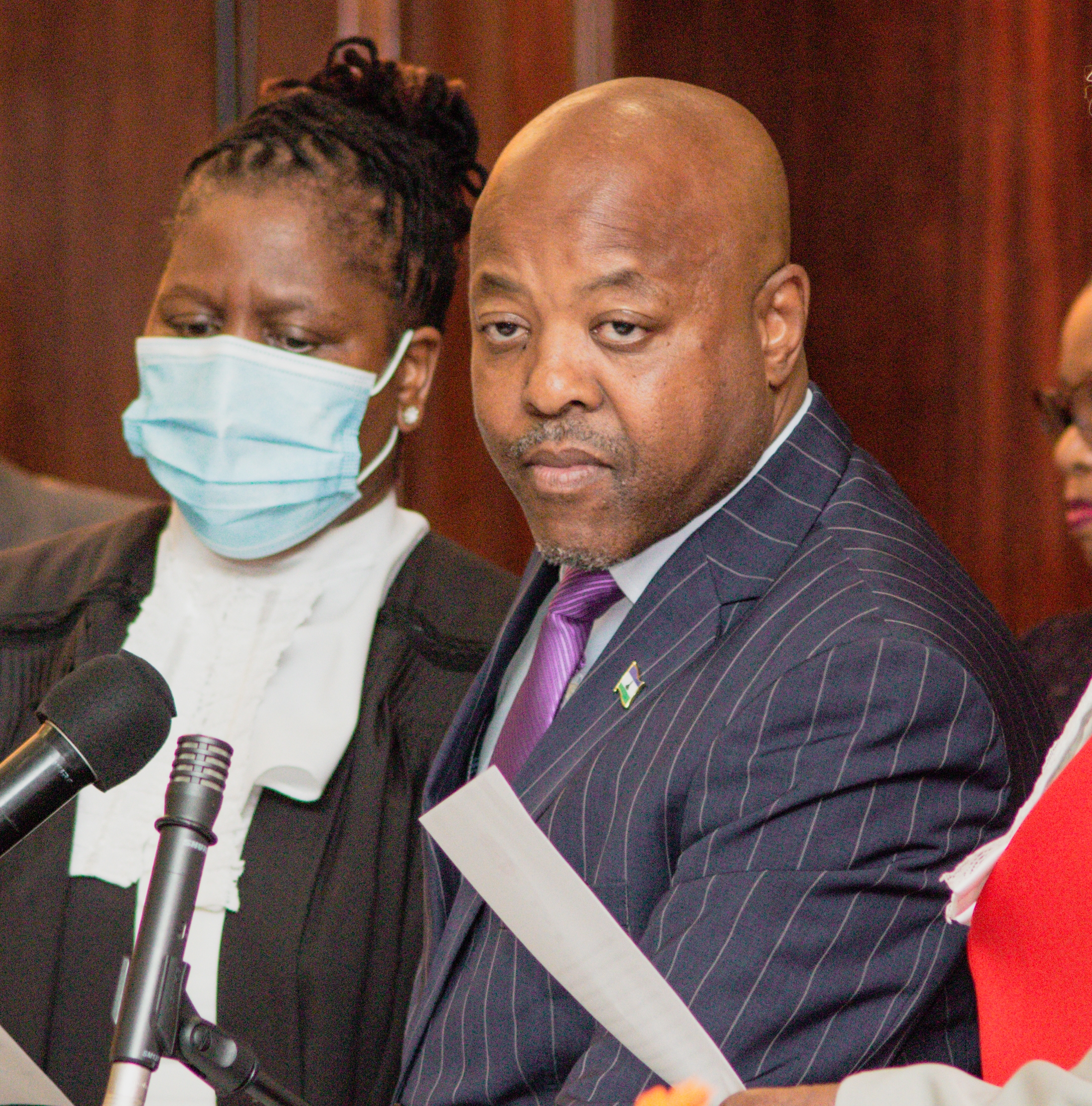

Clifford Elphick, CEO of Gem Diamonds, acknowledged the challenges faced by the company.

“The downturn in the rough-diamond market, together with increased grid electricity interruptions, which increased operating costs, negatively impacted our financial results for the period,†Elphick said.

He emphasised the company’s commitment to stabilising its plants to improve large diamond recoveries and conducting a comprehensive review of all operational and capital expenditures to address the ongoing challenges.

Summary

- Gem Diamonds, the mining group with operations in Lesotho and Botswana, has reported a significant drop in revenue and underlying earnings before interest, taxes, depreciation, and amortization (EBITDA) for the first half of 2023.

- The company, headquartered in the United Kingdom, owns the renowned Letšeng diamond mine in Mokhotlong and the Ghaghoo mine in Botswana, with sales and marketing capabilities based in Belgium and innovation solutions in Cyprus.

- He emphasised the company’s commitment to stabilising its plants to improve large diamond recoveries and conducting a comprehensive review of all operational and capital expenditures to address the ongoing challenges.

Your Trusted Source for News and Insights in Lesotho!

At Newsday Media, we are passionate about delivering accurate, timely, and engaging news and multimedia content to our diverse audience. Founded with the vision of revolutionizing the media landscape in Lesotho, we have grown into a leading hybrid media company that blends traditional journalism with innovative digital platforms.