Bereng Mpaki

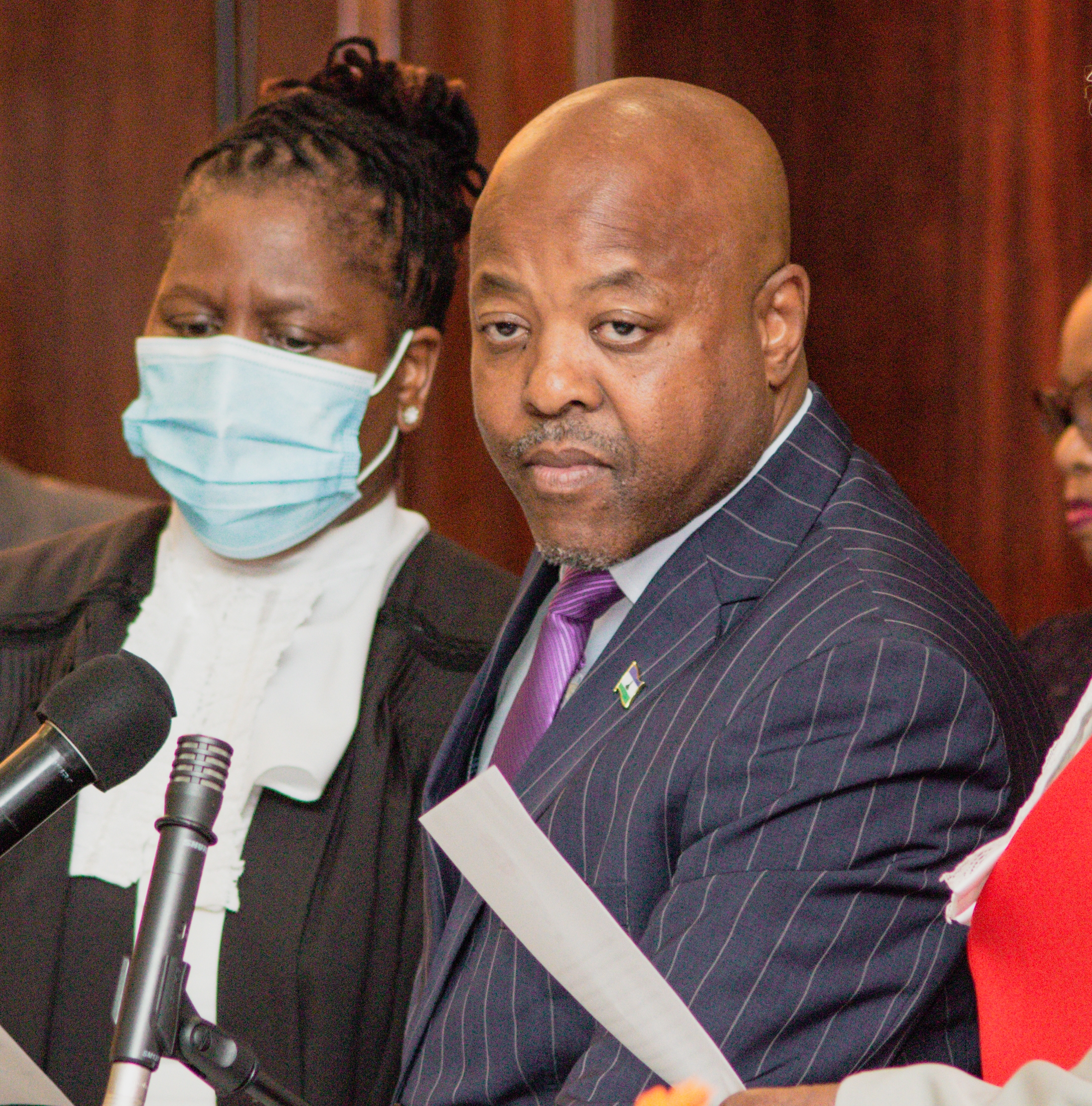

The Minister of Natural Resources, Mohlomi Moleko, views the proposed sale of the 70 percent ownership of Mothae Diamonds Pty Ltd as a strategic opportunity for the government to strengthen its stake in the mine.

With the current ownership structure giving the government a minority 30-percent share in the mine, while the Australia Stock Exchange (ASX) listed Lucapa Diamond Company holds the majority 70 percent, Minister Moleko emphasised that the government holds the prerogative to purchase these shares first, in accordance with section 36 of the Companies Act.

Lucapa Diamond Company recently announced its intention to divest its ownership in the mine, following a comprehensive review of its asset portfolio by its new board of directors.

The mining company, which secured a 10-year mining lease for the Mothae mine in 2017 at an estimated cost of $9 million (approximately M140 million), commenced commercial operations at the site in 2019.

In an exclusive interview with Newsday this week, minister Moleko said while he was yet to present the information on Lucapa’s decision to sell its shares before cabinet, he will recommend for the government to acquire the rest of the mine shares.

“I strongly recommend for the government to purchase the entire shares or part of them in order to increase its shareholding in the mine, provided the government’s finances permit,” Moleko said.

“This is not only a good opportunity for the government to increase its shareholding in the mine, but also to learn how to run the mine and appreciate first-hand some of the dynamics of the business.”

Beneficiation within the diamond industry would also be easier if the government were to fully own the mine, Moleko said.

Nick Selby, Lucapa’s Managing Director and Chief Executive Officer (CEO) has confirmed the government’s interest in taking over the Mothae mine.

“We have kept our partners, the Lesotho government informed along the way and they in turn have indicated their interest in taking over the operation,” Selby said this week during Lucapa’s annual general meeting.

He said they have already indulged preliminary bidders on the relevant information about the mine’s operations.

“Since the announcement two weeks ago, we intend to divest that asset after a board review of our portfolio we have opened the data room to several interested parties. To explain the process, the main stages are: The first is the receipt of non-binding indicative offers after qualifying interested parties have had access to the data room and have done their due diligence. Then those interested parties will be invited to visit site and then final offers will be considered.”

Located in the diamond-rich maluti mountains about five kilometres away from the so-called world’s highest dollar-per-carat kimberlite, Letšeng Diamond Mine, Mothae is an open-cast mine, which is known to produce large, high-value diamonds, which command impressive prices in the market.

While Lucapa said the decision to divest its interest in Mothae was meant to streamline its core assets, the company’s 2023 financial report showed that the quality of Mothae’s diamonds dipped significantly in the fourth quarter of the year.

The report revealed that there were very few high-quality large diamonds recovered in the last quarter of the year, and that challenged the year’s overall performance.

Despite running a US$1.1 million loss during 2022, the financial statements showed that Mothae’s operations improved significantly, with its earnings rising to US$2.9 million in 2023, due to an improved operational performance during the first quarter.

Summary

- With the current ownership structure giving the government a minority 30-percent share in the mine, while the Australia Stock Exchange (ASX) listed Lucapa Diamond Company holds the majority 70 percent, Minister Moleko emphasised that the government holds the prerogative to purchase these shares first, in accordance with section 36 of the Companies Act.

- In an exclusive interview with Newsday this week, minister Moleko said while he was yet to present the information on Lucapa’s decision to sell its shares before cabinet, he will recommend for the government to acquire the rest of the mine shares.

- “This is not only a good opportunity for the government to increase its shareholding in the mine, but also to learn how to run the mine and appreciate first-hand some of the dynamics of the business.

Your Trusted Source for News and Insights in Lesotho!

At Newsday Media, we are passionate about delivering accurate, timely, and engaging news and multimedia content to our diverse audience. Founded with the vision of revolutionizing the media landscape in Lesotho, we have grown into a leading hybrid media company that blends traditional journalism with innovative digital platforms.