- New info indicates it also owes Road Fund ‘M48 million’

- This brings its total known debt to the state to about M179 million.

Tholo Energy, a company once touted as a success story in Lesotho’s fuel sector, is now at the center of a financial scandal of staggering proportions.

With an outstanding debt of M131 million in unpaid petroleum levies since 2019, the company’s financial dealings paint a troubling picture of negligence, evasion, and apparent complicity by regulatory authorities.

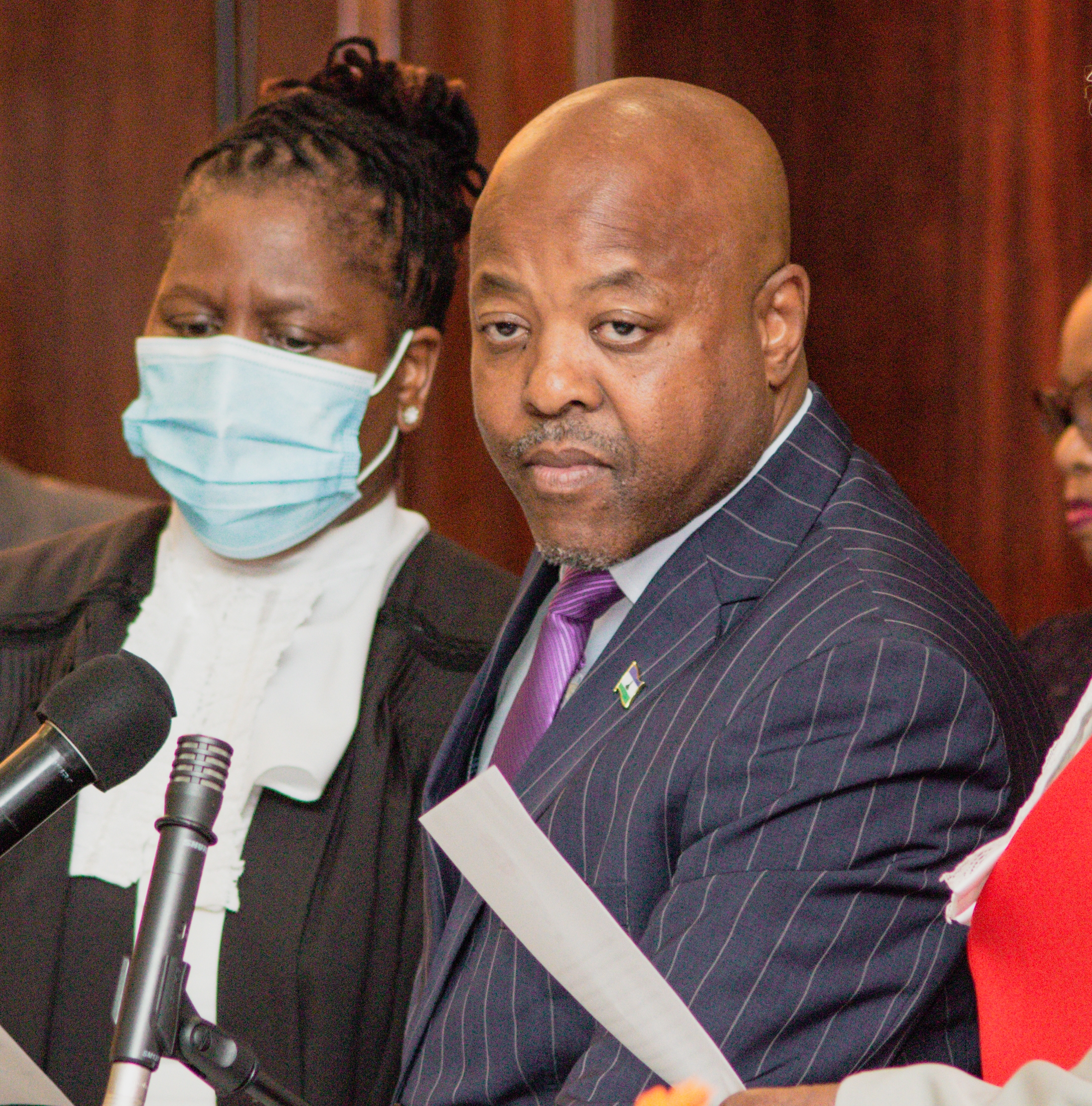

Natural Resources Minister, Mohlomi Moleko, informed the parliament’s portfolio committee on natural resources this week that his ministry, in collaboration with the Ministry of Finance and Development Planning, has decided not to renew Tholo Energy’s trading licence until the M131 million debt is settled.

Further investigation by Newsday revealed that the M131 million is only part of the company’s arrears. Sources told this publication yesterday that Tholo Energy also owes the Road Fund about M48 million in road maintenance levies.

The Road Fund was originally established by the Lesotho Government under the Finance Order of 1988 and became operational through the Finance (Roads Fund) Notice of 1995 (Legal Notice 179/1995).

It operated under this legal framework until 2005, when the Finance (Road Fund) Regulations of 2005 were introduced.

Following the enactment of the Public Financial Management and Accountability Act of 2011 (PFMA 2011), the Road Fund Secretariat was incorporated into the funds established under Section 21(3) of the PFMA.

It is governed by the Finance (Road Fund) Regulations of 2012 and is responsible for collecting revenue and disbursing funds for road maintenance.

The inception of the Road Fund, mirroring global best practices, was driven by the imperative to recalibrate the financial architecture underpinning Lesotho’s road infrastructure.

Rather than perpetuating reliance on general tax revenues amassed by the central government, the Fund sought to institute a self-sustaining model wherein road users themselves would bear the fiscal responsibility for the upkeep of the nation’s vital transport arteries.

This strategic shift was necessitated by the chronic funding deficits that had historically plagued road maintenance, impeding both the longevity and reliability of critical infrastructure.

To facilitate the continuous enhancement of the country’s road network, revenue is amassed from a diverse array of sources, chief among them being the road maintenance levy imposed on petrol and diesel.

This means Tholo’s alleged unpaid M48 million is a significant shortfall.

Road Fund officials confirmed the debt to Newsday yesterday but declined to specify the amount.

“We acknowledge that Tholo Energy does owe the Road Fund under the road maintenance levy stream. The Road Fund Secretariat in consultation with relevant stakeholders is continuously engaging with Tholo Energy to ensure that the debt is recovered in the most reasonably economic manner having considered several factors,” Phumla Moleko, Road Fund’s head of corporate communications, said.

“We will, however, not be in a position to divulge the specific amount as a show of good faith and trust in the process being followed,” Moleko added.

Newsday learned that the Fund considered legal action against Tholo Energy last month, but the company proposed a payment arrangement, staving off a lawsuit for now.

Minister Moleko told the committee that Tholo Energy has repeatedly defaulted on payment plans for the M131 million petroleum levy debt. He noted that the company’s trading licence has already expired and warned that liquidation proceedings would follow if the debt remains unpaid.

Moleko acknowledged that the government had shown leniency toward Tholo because it is a locally owned firm, but that patience has run out.

However, Ministry of Energy Principal Secretary (PS), Tankiso Phapano, offered a different perspective and attributed the delay to a dispute over the exact amount owed. Phapano said the government and Tholo Energy only agreed on the M131 million figure last year and are now negotiating a payment plan.

Newsday’s investigation, however, reveals that Tholo Energy’s troubles extend far beyond these unpaid levies. Last month, Newsday reported on an alleged M450 million tax fraud scandal involving the company and its managing director, Thabiso Moroahae.

A whistleblower provided evidence to the Financial Intelligence Unit (FIU), Directorate on Corruption and Economic Offences (DCEO), Lesotho Mounted Police Service (LMPS), Revenue Services Lesotho (RSL), and Director of Public Prosecutions (DPP), Advocate Hlalefang Motinyane.

Despite the FIU concluding an investigation in 2024 and sharing findings with relevant authorities, no action has been taken. Responses from law enforcement ranged from vague excuses to silence, raising questions about accountability in high-profile cases.

Adding to the company’s woes, Newsday reported in February 2024 that South Africa’s High Court dismissed an appeal by Tholo Energy Services CC, a Moroahae-controlled entity, in a R4.25 million tax refund scam.

Judge Molotsi ruled that the company’s claims were fraudulent, exposing deceptive fuel transport practices. Tholo Lesotho, also led by Moroahae, supplies fuel sourced from South Africa to local customers, while Tholo Energy Services operates as a fuel distributor across Southern Africa.

Summary

- Tholo Energy, a company once touted as a success story in Lesotho’s fuel sector, is now at the center of a financial scandal of staggering proportions.

- Natural Resources Minister, Mohlomi Moleko, informed the parliament’s portfolio committee on natural resources this week that his ministry, in collaboration with the Ministry of Finance and Development Planning, has decided not to renew Tholo Energy’s trading licence until the M131 million debt is settled.

- The Road Fund Secretariat in consultation with relevant stakeholders is continuously engaging with Tholo Energy to ensure that the debt is recovered in the most reasonably economic manner having considered several factors,” Phumla Moleko, Road Fund’s head of corporate communications, said.

Authored by our expert team of writers and editors, with thorough research.