Staff Reporters

The management of Storm Mountain Diamonds (SMD) has announced a temporary halt to the processing plant at Kao Mine in Botha Bothe starting on July 9 this year, citing operational difficulties and adverse weather conditions.

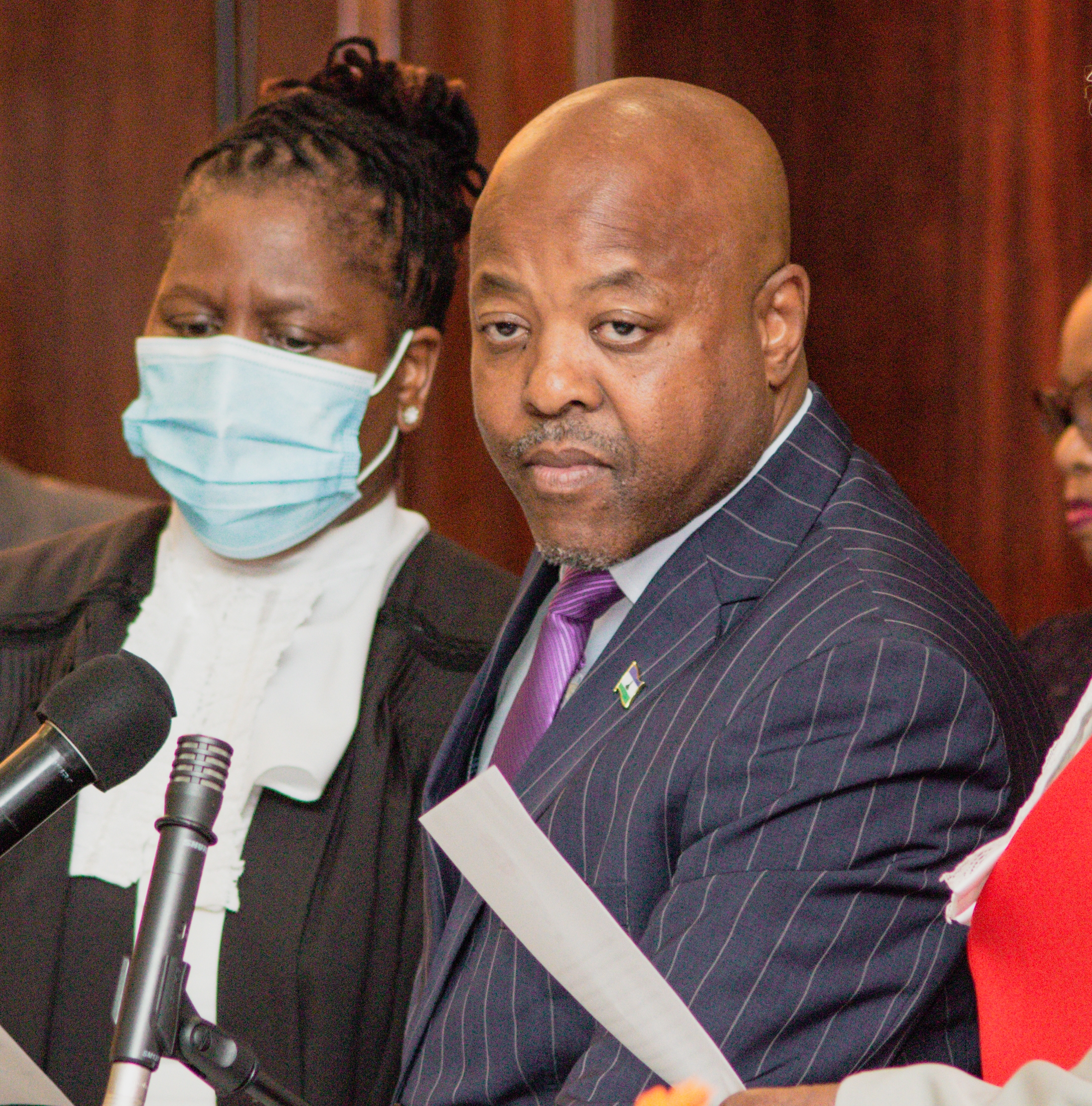

“The events that have caused the plant stoppage are the unavailability of mining material to feed the plant together with the logistical difficulties caused by the current severe weather conditions, which delay the procurement of essential consumables, most notably the emulsion required for blasting,” Robert Cowley, Chairman of the Board, stated in a memo to employees on July 8.

Cowley reassured that the plant would restart either once mining stock is replenished or “it is otherwise suitable to resume plant operations.” He emphasised that apart from this stoppage, work would proceed as normal.

“Currently, SMD is facing some challenges, whilst at the same time, exploiting further opportunities,” he noted. Cowley highlighted that overcoming challenges is not new for SMD, stating: “We have faced and overcome challenges before, and have always taken initiatives and opportunities to ensure that we maximise benefits for all stakeholders sustainably and responsibly.”

Amidst these operational and external challenges, Cowley mentioned that SMD is in the midst of a significant and capital-intensive plant expansion project aimed at substantially increasing the life of the mine.

Addressing market conditions, Cowley disclosed that the current state of the market is depressed, impacting the prices SMD achieves for its goods. He explained: “The drop in market prices is driven by various market factors, including global conflict, and a current over-supply in rough diamonds. As commodity prices are cyclical, the market will improve; however, it is not clear when, and indications are that the prices will remain suppressed in the medium term.”

Cowley also addressed a recent income tax assessment by the Revenue Services Lesotho (RSL), which SMD believes to be incorrect.

“We believe that the assessment will be set aside in the long run by following the formal processes as set out in the law,” he stated. Nonetheless, the assessment imposes a significant financial strain, as the law generally requires payment even if an objection is lodged.

“SMD is assessing all possible responses to these challenges. In an ever-changing environment, all options need to be considered, even short periods of stoppage, to see out difficult periods. Even though these are being assessed, stoppages remain the last resort,” Cowley explained.

He urged employees to work on increasing efficiencies and reducing costs and wastage during this period.

Due to the poor market conditions, SMD’s margins are under threat, and as a result, production bonuses have been temporarily suspended. “Production bonuses have to be temporarily suspended until further notice,” Cowley confirmed.

Despite these challenges, SMD is proceeding with the HPGR capital expansion project.

“SMD’s funding shareholders and its Board believe in the longevity and sustainability of the mine and continue to support the expansion project. The project will also bring improved technologies and economies of scale that will assist in future-proofing the business against similar threats,” Cowley stated.

“We will continue to exploit all our opportunities in a responsible way to ensure that Kao Mine remains a sustainable business,” he concluded.

SMD is jointly owned by Namakwa Diamonds Limited and the government of Lesotho. The government holds 25 percent of the free carry shares in SMD and the operations are entirely funded by Namakwa Diamonds Limited.

SMD operates Kao Mine, the fourth largest kimberlite pipe in Southern Africa – and the largest kimberlite pipe in Lesotho – from a coverage perspective at 19.8 hectares, with an indicated and inferred resource base of 12.7 million carats.

Kao’s pipe has been explored and confirmed to a depth of 500m.

A deposit with exceptional prospects, Kao yields rare coloured diamonds ranging from purple, pink, blue, yellow, and top light brown to classic whites.

Globally, ‘fancy coloured’, also known as rare diamonds, are regarded as an exceptional investment. The blues, pinks, and purples tend to be the rarest with the exception of red; the rarest of the rare.

The mine’s diamonds are sold on tender in Antwerp, through sales and marketing partners; Bonas Couzyn Antwerpen NV.

Summary

- “The events that have caused the plant stoppage are the unavailability of mining material to feed the plant together with the logistical difficulties caused by the current severe weather conditions, which delay the procurement of essential consumables, most notably the emulsion required for blasting,” Robert Cowley, Chairman of the Board, stated in a memo to employees on July 8.

- Amidst these operational and external challenges, Cowley mentioned that SMD is in the midst of a significant and capital-intensive plant expansion project aimed at substantially increasing the life of the mine.

- “We believe that the assessment will be set aside in the long run by following the formal processes as set out in the law,” he stated.

Your Trusted Source for News and Insights in Lesotho!

At Newsday Media, we are passionate about delivering accurate, timely, and engaging news and multimedia content to our diverse audience. Founded with the vision of revolutionizing the media landscape in Lesotho, we have grown into a leading hybrid media company that blends traditional journalism with innovative digital platforms.