Staff Reporters

Rising petrol and other consumables costs have set back Mothae diamond mine’s operating margins by an estimated M180 million during the 2022 financial year.

This challenge was compounded by logistical issues leading to delays in sourcing of critical machinery spare parts.

These are highlighted in the recently released 2022 annual report for Lucapa Diamond Company Limited, which is the majority shareholder of Mothae Mine.

The Australia Stock Exchange (ASX) listed Lucapa holds 70 percent of shares while the government holds the remaining 30 percent in the mine.

While Mothae achieved a record output of 1,207,060 tonnes of ore for the year in review, resulting in a seven percent increase compared to the previous year, 2022 was a challenging year for the mine.

“Energy cost inflation saw diesel, explosives, and consumables increase input costs during the year, which materially impacted operating margins,†the report said.

It said logistical issues affecting the wider mining industry were also felt at Mothae, where the mining contractor experienced lengthy delays in sourcing parts and spares for critical machinery and therefore, impacting mining productivity and efficiencies.

“As a direct result of the energy cost inflation and mass balance challenges noted above, Mothae booked a non-cash impairment charge of US$10.6 million (about M180 million) during the year.â€

The mine has also recovered 30,740 carats during 2022, which is five percent lower than the previous year due to the lower grade previously mentioned.

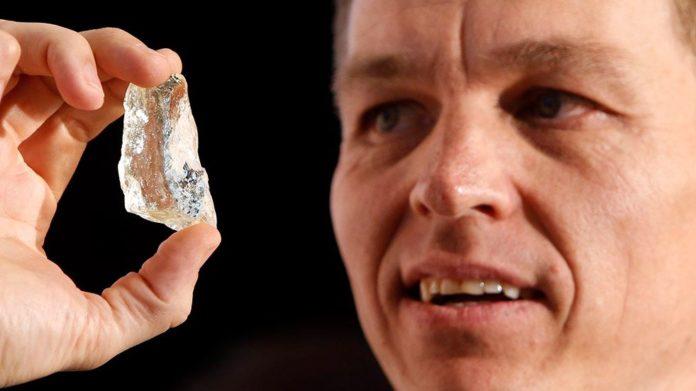

“Recoveries included 197 Special sized stones and 651 diamonds greater than 4.8 carats, an increase of 17 percent and four percent respectively over 2021 and both annual records. Of the special-size stones, four were more than +100 carats in size with the largest weighing 204 caratsâ€.

During the year under review, 12 diamond sales for Mothae diamonds were held with revenues of US$22.1 million (A$33 million) achieved at an average diamond price of US$690 (A$987) per carat.

“Diamond revenues of US$22.1 million were achieved at Mothae for 2022 at an average diamond price of US$690 (A$987) per carat. The cutting and polishing activities performed well in 2022, with Mothae receiving an additional US$0.8 million in cutting and polishing margins.

“As per the partnership agreement, Safdico purchased the run-of-mine production from Mothae for the year with Mothae paying the full market value of the rough diamonds upfront, sharing equally in the margins generated thereafter.â€

Diamond prices, however, continued to strengthen at the beginning of 2022 with the overall rough diamond index reaching an all-time high before retreating.

The mine has also concluded the development of new solutions to improve treatment facility efficiencies and increase production during the year.

“Very pleasingly, the investigations and modelling into improving treatment facility efficiencies and increasing throughput concluded just prior to year’s end, with good solutions presented. These low-cost solutions were implemented early in 2023 and are already showing positive results.â€

Summary

- While Mothae achieved a record output of 1,207,060 tonnes of ore for the year in review, resulting in a seven percent increase compared to the previous year, 2022 was a challenging year for the mine.

- It said logistical issues affecting the wider mining industry were also felt at Mothae, where the mining contractor experienced lengthy delays in sourcing parts and spares for critical machinery and therefore, impacting mining productivity and efficiencies.

- “As per the partnership agreement, Safdico purchased the run-of-mine production from Mothae for the year with Mothae paying the full market value of the rough diamonds upfront, sharing equally in the margins generated thereafter.

Your Trusted Source for News and Insights in Lesotho!

At Newsday Media, we are passionate about delivering accurate, timely, and engaging news and multimedia content to our diverse audience. Founded with the vision of revolutionizing the media landscape in Lesotho, we have grown into a leading hybrid media company that blends traditional journalism with innovative digital platforms.