Staff Reporter

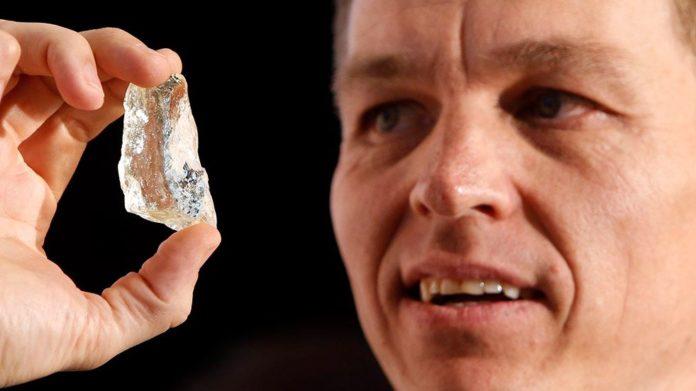

Mothae mine’s unit price for its diamonds dipped to US$896 per carat during the third quarter of 2023 compared to an average of US$940 per carat attained in the first half of the year.

The mine sold 6836 carats at US$806/ per carat from two sales tenders during the period under review. Mothae has forecast its diamonds to average US$1000 per carat by the end of 2023.

This is highlighted in the quarterly activities report of Mothae’s majority shareholder Lucapa Diamond Company. The Australia Stock Exchange (ASX) –listed Lucapa owns 70 percent of Mothae with the government of Lesotho holding the remaining 30 percent shares.

Despite the slight decline in its diamond prices, the mine is on course to meet its full-year production projections.

“As at the end of Q3, Mothae continues to track in line with the full year guidance announced on the 30 March 2023 and therefore the full year guidance is maintained,†the quarterly report said.

“Mothae continued to perform well in Q3, with tonnes processed up 14 percent year on year (yoy). The operation delivered 39 percent more +4.8 carat diamonds and 77 percent more +10.8 carat diamonds than the previous corresponding period, resulting in an improved price per carat and total revenue.â€

The mine has also seen its revenue for the period under review registering a 12 percent increase compared to the same period in 2022. This was after Mothae deployed a mobile crusher during the quarter to reduce the amount of oversize material on the stockpiles.

The crusher has been operating efficiently and has had a positive impact on the plant throughput and reduced the need for in-pit ore re-handling.

“Only two sales took place during Q3 as no sales are conducted in August. Total revenue for Mothae was up 12 percent on Q3/22 at US$5.5 million (A$8.4 million). The 6,836 carats sold to the partnership with Safdico attracted US$806/carat (A$1,236).

Commenting on the quarterly performance, Lucapa’s recently appointed Managing Director, Nick Selby said; “Mothae continues to perform strongly and had a very positive quarter.â€

“As the recent tender results confirmed, large, high-quality diamonds such as those produced at Lulo and Mothae are still attracting strong prices and are in high demand compared to the smaller goods used by mainstream jewellers.â€